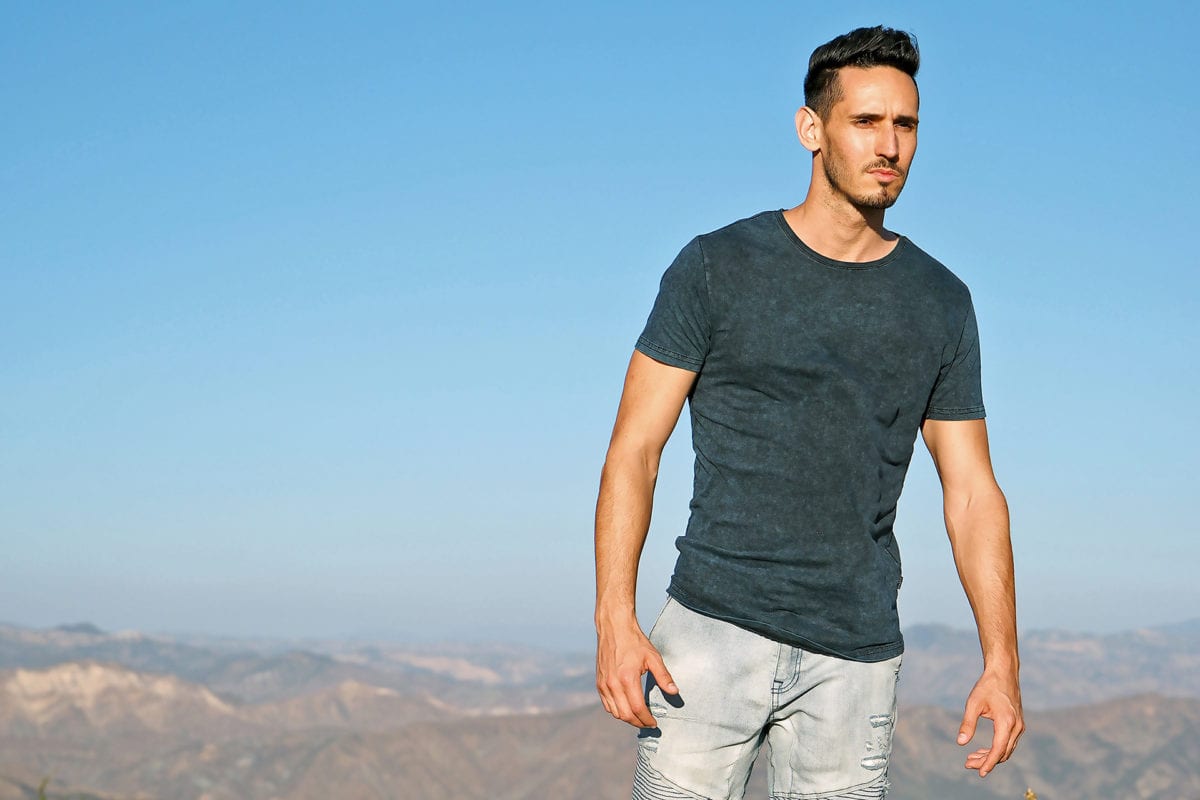

For 15 years, Loren Shifrin has worked in the factoring business, garnering a sterling reputation before launching his own successful company, REV Capital, in 2017. In a few short years (and through the economic trials of the pandemic), REV Capital has grown into the largest factoring company in Canada, with aims to expand throughout North America. The 33-year-old shared the secret to his success, the lessons he learned as a young entrepreneur, and explained the basics of the lesser-known factoring industry.

To what do you credit REV Capital’s rapid success?

One is the hard work and dedication of our team. We’ve got over 100 people working for the company, most of whom are in Canada. All of them are very much committed to what we’re trying to do, which is to support small businesses in their growth. I have surrounded myself with a lot of people who are much smarter and more talented than I am. It’s their hard work that has helped us achieve a lot of the success that we’ve seen.

Another thing that’s been a great help to us is our reputation. From day one, building a solid reputation for the company has been very important — being a transparent, fair, customer-centric factoring company that legitimately cares about the growth of its clients, employees, and the stakeholders of the company.

We’ve built the foundation of our growth on transparency, honesty, keeping our word, taking responsibility for our mistakes, and providing our clients with exactly the level of service that we promised.

What is a lesson you have learned from the early phase of launching REV Capital?

One of the earliest lessons I learned is that I can’t do everything myself. I’ve been in this industry for about 15 years, and, most of that time, it’s been in management level positions. Early on in my career, I tried to do everything myself. I wanted to be in charge of operations, sales, and marketing. It wasn’t until my partners and I started REV that I had to learn to shift that mentality and realize that I can’t be all things, especially not to all people. Ironically, it wasn’t until I started to entrust and empower my staff —my partners and my employees — to do their jobs as well as they do them that the company really started to grow and take off. Very few companies in our industry have been able to achieve the level of growth that we have, especially in such a short amount of time. I really do attribute it to the fact that I’ve learned to trust those around me.

What do people not know about factoring that you wish they knew?

Interestingly, in Canada, most people don’t even know what factoring is, and that’s something that I’ve been trying to fix for most of my career. I’d love for more Canadians to know about factoring and its benefits. For those who don’t know, factoring is a form of financing where a factoring company, such as ours, purchases accounts receivables or invoices from other companies to help them with their cash flow.

For example, think of any company that provides a service or a product to another business. Once they’ve completed that, they generate an invoice and instead of sending it to their client, they’ll send it to us and we’ll pay them for it, the same day. The reason we do that is because, generally, debtors pay in 30, 60, or 90 days, and a lot of these companies, especially growing ones, can’t afford to wait that long for their money to come in. So, we pay them the same day and then we sit and wait for the debtors to pay us.

Once I’ve educated people on what factoring is, I suppose that the one thing that I’d like more people to know is that there is no more flexible form of financing for a growing business. Traditional lenders (if businesses are even able to get to a traditional lender) usually offer lines of credits that are stagnant or have limits, whereas a factoring facility actually grows with the company. If I have a company that has a hundred thousand in receivables, I’ll give them, let’s say, a $200,000 facility. As soon as they’re peaking up against that $200,000 limit, we’ll increase it again because, at the end of the day, we understand that their growth is intricately tied to our growth.

Can you discuss the importance of mentorship and building relationships in your career?

I’m actually quite young. I’m 33 and I’ve been in the factoring industry since I was 18. Very early on in my career, I was the only person my age sitting at most of the meetings I was in and having the types of conversations that I was having. It was a little bit alienating, but I learned early on that there were people who cared about my success and wanted to see and help me grow. I had to learn to look to a few people who I now consider to be mentors to help me figure out a lot of the stuff over the last 15 years.

It took me a long time to understand this, but I believe that relationships are everything. In the first 10 years of my career, I built tons and tons of relationships, and it wasn’t until I started REV Capital five years ago that I realized I then needed to bank on those relationships. In the first year of REV’s existence, we signed hundreds of clients, all by word-of-mouth. It was on the backbone of the relationships that I had built because people knew who I was, and they knew about my reputation. They knew that if I was in charge of this company and I gave them my word, I would keep it and that the company would keep it. Everything kind of spiraled from that.

Rose Ho | Assistant Editor