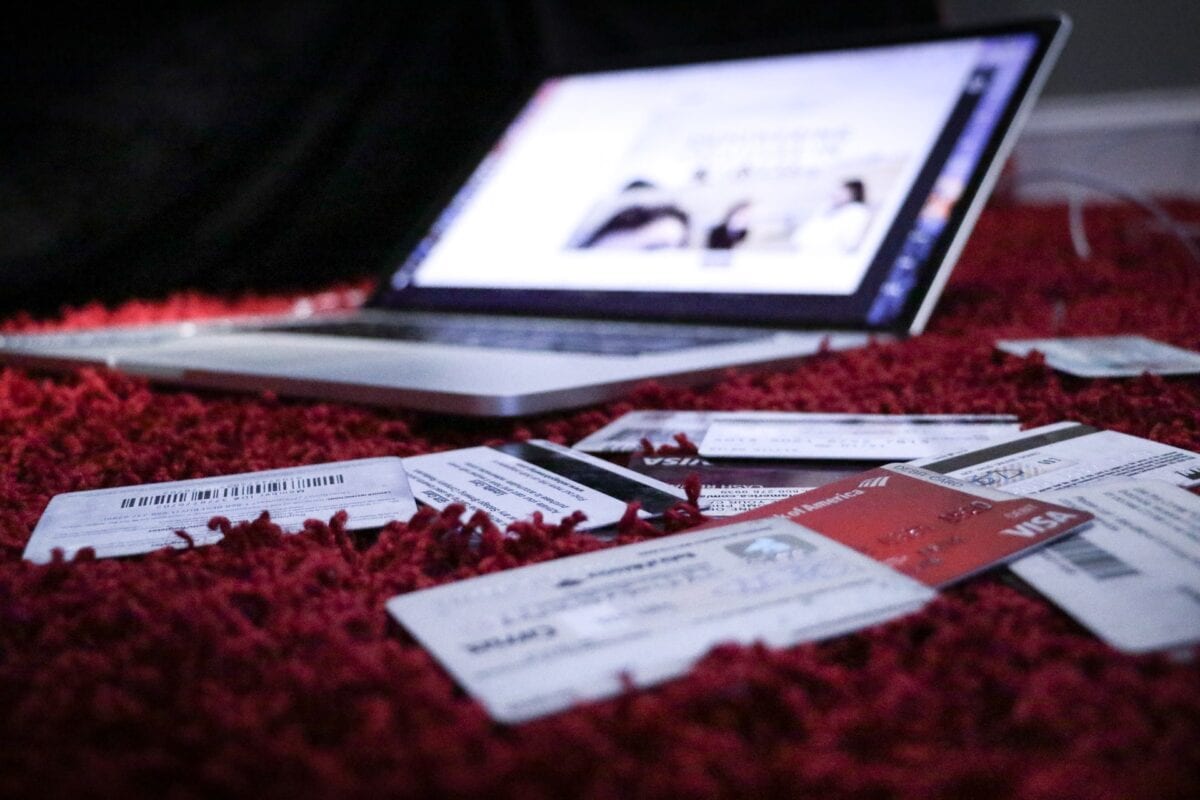

You’re in debt and it feels like you’re stuck in the huge hole you dug yourself into. It’s affecting your credit score, and trying to rebuild it is very discouraging. But it’s up to you to find a ladder to climb out of that hole. And trust me, it’s possible!

You don’t need a larger income, or need to win the lottery to get out of debt and improve your credit. Sure, attaining a large amount of money will get you out of debt, but your credit score won’t rise significantly.

Therefore, you need to shift your focus to paying off your debt while repairing your credit score – not just paying off your debt. So, how do you do this?

Make Payments, On Time!

Sometimes it is tough to make payments on time. But paying your credit card bill late is known to evolve into a bad credit habit – you will start to neglect your debt and it will be sent to a collections agency.

Late payments portray you as unreliable and a risk to the lenders. Even one late payment puts red flags on your credit report, and could stay on for seven years. In addition, you lose trust with lenders and can be viewed as financially unstable.

You want to be seen as a reliable borrower – you do that by making your payments on time. If you don’t have the money to pay off your bill, pay the minimum. And if you struggle to pay off the minimum, contact the lender of the credit card company to discuss payment plans with you. It might not fix your credit score, but it will show that you’re responsible with your finances.

Set Up a Debt Management Program

If you have difficulty being financially responsible because you use multiple credit cards, then setting up a debt management program is for you. This program enables you to pay off all your debt in one monthly payment.

It works like this: you pay a monthly bill to the credit counselling organization and they divide the payment to our credit card(s), line-of-credit and/or loans. However, according to mymoneycoach.ca, your creditors must agree with the counselling organization that this program is suitable for you.

Removal of Late Payments

As mentioned above, late payments stay on your credit report for seven years. This is why it is important to get it removed from your credit report A.S.A.P. And it’s not that hard.

According to Ryan Greeley from bettercreditblog.org, there are three ways to get late payments removed from your credit history. But the most successful way, according to the many comments written in Greeley’s blog, is to ask for automatic payments. This will show that you’re motivated and will ensure the lenders or credit companies that future payments will be made on time.

Removal of Collections

If you’ve neglected your payments and debt, it is quite possible that the credit card company has put you in the hands of a collection agency. And having a collections agency after you is never a pleasant feeling.

But, like the removal of late payments, you can get collections removed from your credit report. The first step is to figure out what the problem is and how it got into the hands of the collection agency. This is why you should request a copy of your credit score report from Equifax Canada or TransUnion Canada – it’s free! Then write a goodwill letter that asks for any negative reports to be removed and send it to the credit company. An ideal goodwill letter should be written in an appreciative tone that shows you take responsibility, that you recently have a good payment history, and that you’re straight to the point – that you want the bad credit history removed.

Don’t Max Out Your Credit Card

Maxing out your credit causes your interest rates and your minimum payments to rise to an unmanageable amount, and your card becomes unusable.

What would you do if you don’t have money saved, your card is maxed out and an emergency happens? You will have to apply for another card, and you will probably get declined since your credit score is low. This is why creating a spending budget is essential to your credit score.

Create a Spending Budget

Having a spending budget enables you to never use more than 75 per cent of your credit limit. Anything over the 75 per cent mark is considered high-risk. So, if your credit limit is $100, never use more than $75.

A spending budget enables you to pay off your debt and put money into a savings account, while not crossing the 75 per cent threshold. Having a spending budget is a life saver when an emergency occurs. Instead of taking money from a line-of-credit or a credit card, you withdraw from your savings account. (Visit mymoneycoach.ca to learn how to start and create a spending budget.)

Reduce Your Interest Rates

With a lower rate, your payments become more manageable. According to Shannon McNay from Mybanktracker.com, the best way to lower your interest rates is by getting a balance transfer credit card. These credit cards are ONLY designed for paying off debt. Many come with an interest rate of zero per cent.

But it doesn’t last too long. Usually, the special zero rate lasts six months to a year. After that, the interest rates rocket up. So, if you don’t finish paying off your original balance, then you can apply for another to pay off the rest. Remember, it is always easier to pay off debt when the interest rates are low.

Don’t Close a Credit Line

People often have the mentality to close their line-of-credit or cancel their card after paying off their debt. But this has a negative effect. Having no debt – yes, I said no debt – is worse than having little debt because you can’t have any credit history to your name. If you use less than 10 per cent of your available credit, you will not see any boosts in your credit score.

Therefore, it’s a good idea to always carry a small balance on your credit line or card. Here is a tip: never exceed 30 per cent of your credit available. Also, the older your account the better credit you’ll have.

Maintain It and Make It Glow

After working hard to get your credit report to a reasonable score, it is up to you to maintain your score and make it glow! This means you still need to make payments on time, have a budget and never max your credit card. You will make your credit score glow if you continue to actively engage in the activities mentioned above, even after you pay off your debt. Remember, if you exceed the 75 per cent threshold you should review your spending budget and see where you made a mistake. It is always a good idea to request a credit report every year to see where you stand and to see if there are any errors.

M. Policicchio | Contributing Writer